Trust is an important component in any marketplace, but particularly so in marketplaces that deal with physical products or services (as opposed to digital products), as these cannot be verified directly by the marketplace team.

There are several features and workflows in MarketKing that can be used to maintain trust in the marketplace:

Escrow

With most payment gateways (except Adaptive gateways) in MarketKing, the way payments work is that the funds are collected by the admin / marketplace, and not by the vendor directly. Then only at a later time, depending on the marketplace's policies, will these funds be forwarded to the vendor. This works as a built-in escrow feature, where the marketplace is the trusted 3rd party that can control funds, oversee transactions and mediate disputes between vendor and customer.

Order Status Control

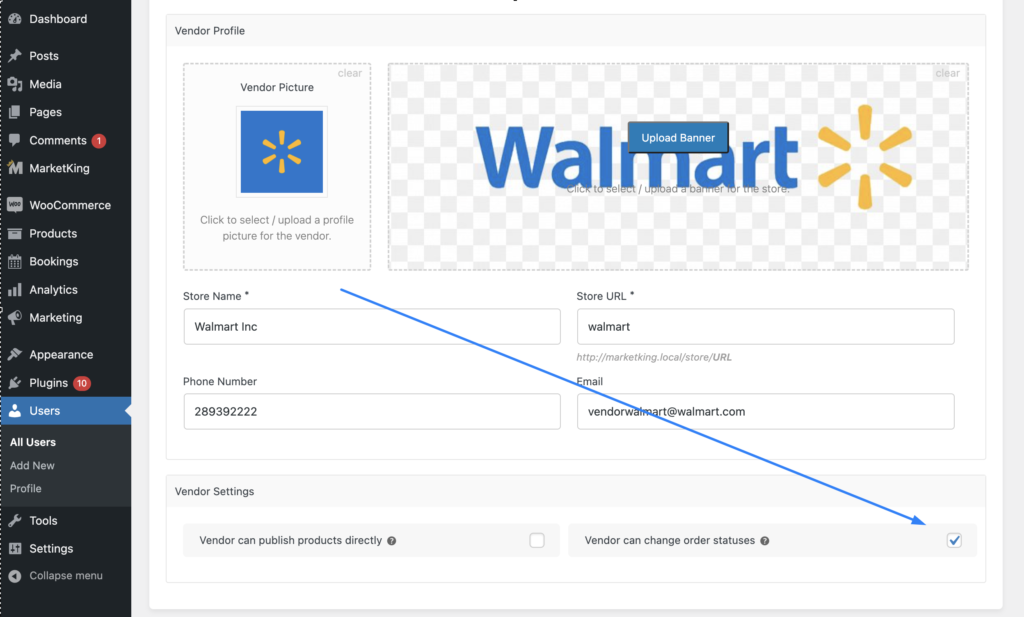

An important feature that can help with this is order status control by vendor.

In MarketKing, funds are released to the vendor balance (not physically paid out), when the order status is marked as completed. It can be configured for each vendor whether they can change order status for their own orders (thus finalising the order).

Workflow example:

- The admin can disable "Vendors Change Order Status" in MarketKing -> Settings -> Vendor Capabilities. This is a global setting. Now this can be set for each vendor individually.

- For a vendor's first orders the admin can choose to manually oversee the orders, and confirm with customers that they received the products in good condition. After confirming with customers, the marketplace manager will mark the order as completed, thus releasing the funds into the vendor balance.

- After 100 orders, if the manager decides the vendor is sufficiently trustworthy, they can be allowed to control order status themselves. The manager can move the vendor from the "New Vendors" group to the "Trusted Vendors" group.

Vendor Security Deposit / Bail

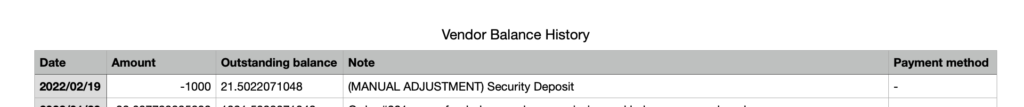

Since the marketplace collects funds before they're released to vendors, it's possible for the marketplace manager to hold a security deposit (e.g. in case the vendor fails to deliver, provides fake products, etc.).

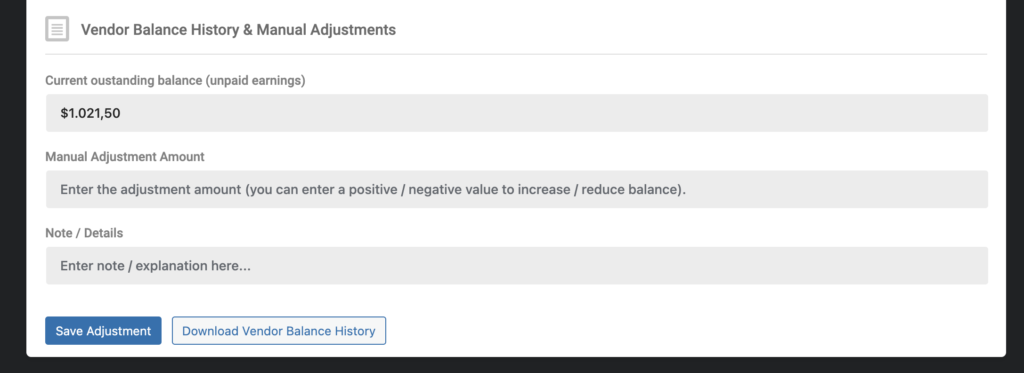

For example the first $1000 sold by the vendor can be held as a deposit, and only released at a later time (e.g. a year later) when the vendor has proven to be trustworthy. This can be achieved in MarketKing by making manual balance adjustments in the vendor balance history (in MarketKing -> Payouts):

Workflow example:

- When a vendor first joins the site they are placed in the "New Vendors" group.

- After several orders when the vendor balance reaches $1000, the admin makes a manual adjustment in the vendor balance, reducing it to 0, marking the $1000 as a security deposit.

- After 6 months without negative incidents, the vendor is moved to the "Tested Vendors" group, and the deposit is released. This is done by going to MarketKing -> Payouts and making another manual adjustments to increase the vendor balance.

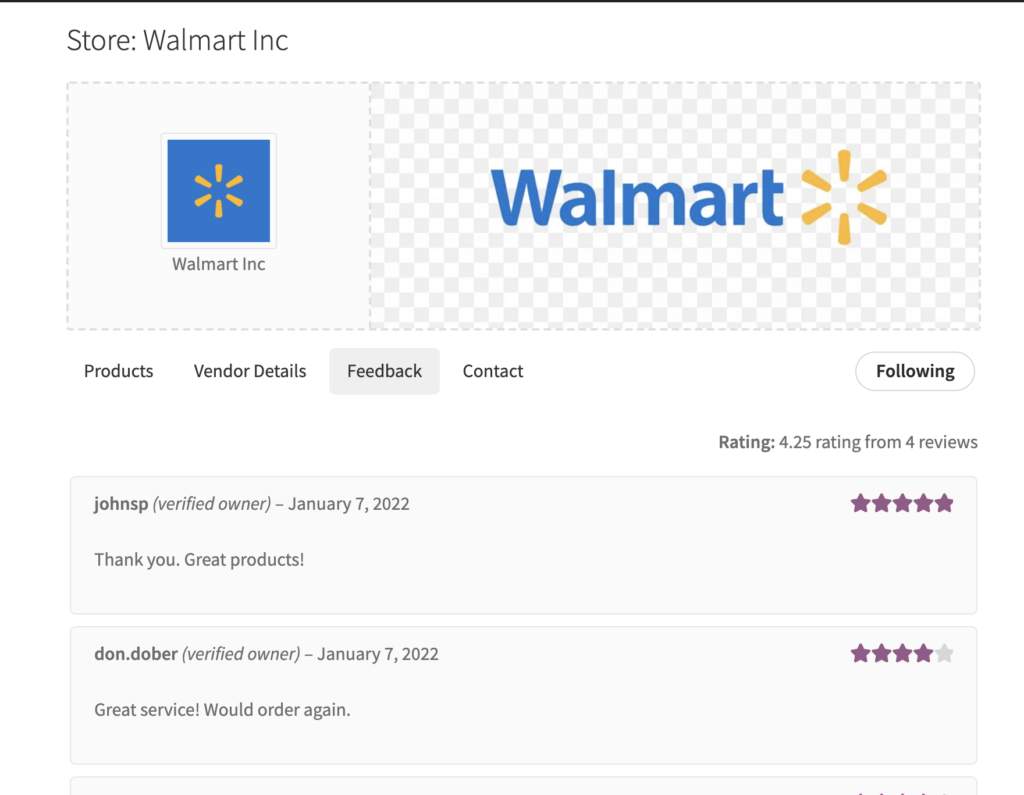

Store Reviews

Another important system that ensures trust is of course, the reviews module. Customers can leave reviews, and vendors have a reviews average score that is displayed on their products and store pages.

Vendors have an important financial incentive to provide good products and services, and collect positive reviews, which in turn improve sales. A vendor who provides bad quality products will quickly get a low rating score, and lose almost all business.